35+ what percent of mortgage to income

Lock Your Rate Today. Web Its a good time to be a yield-hungry investor.

Need A Mortgage Keep Debt Levels In Check The New York Times

Web To illustrate if your monthly gross earnings are 9500 and net earnings are 8000 your monthly mortgage payment should be between 3325 9500 35 and.

. With a Low Down Payment Option You Could Buy Your Own Home. The Federal Reserves aggressive interest rate hikes over the past year have pushed a number of US. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage.

Were not including additional liabilities in estimating the. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad 10 Best House Loan Lenders Compared Reviewed. Most of the land mass of the nation outside of large cities qualify for USDA.

For example if you make 3500 a month your monthly. Top backend limit rises to. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Most home loans require a down payment of at least 3. No more than 28 of a buyers pretax monthly income should go toward. Keep your total monthly debts including your mortgage.

Using a mortgage-to-income ratio no more than 28 of your. Web The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

45 if were talking mortgage alone. Web This is a key ratio to understand if youre wondering what percent of income your mortgage should be. Comparisons Trusted by 55000000.

Keep your mortgage payment at 28 of your gross monthly income or lower. Web Taxes are 104k for the whole year. Heres how lenders typically view DTI.

Get Instantly Matched With Your Ideal Mortgage Lender. Explore Top Rated Information. Maximum allowable income is 115 of local median income.

So around 6 of our gross income on the mortgagetaxes. The indexed brackets are adjusted by the inflation factor and the results. With a Low Down Payment Option You Could Buy Your Own Home.

Ad Tired of Renting. 36 DTI or lower. Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment.

Why Rent When You Could Own. Web How much of your income should go toward a mortgage. The 25 post-tax model This model states your total.

But the X factor is that we live in. Ad Calculate Your Payment with 0 Down. A 20 down payment is ideal to lower your monthly.

According to this rule a maximum of 28 of ones gross. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Ad Calculate Your Payment with 0 Down.

Web The amount of money you spend upfront to purchase a home. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Web According to the 2018 Consumer Financial Literacy Survey from the National Foundation for Credit Counseling 36 of senior citizens ages 65 and older have a mortgage with 7. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web Under state law Minnesotas income tax brackets are recalculated each year based on the rate of inflation.

See how much house you can afford. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. So with 6000 in gross monthly income your maximum amount.

Web The 35 45 model gives you more money to spend on your monthly mortgage payments than other models. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. A lender suggests to not.

Calculate How Much You Can Borrow - Determine How Much House You Can Afford Now. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The Bottom Line.

The 2836 rule is a good benchmark.

Why Isn T Anyone Talking About This Realtors Will Always Say It Is The Best Time To Buy Wow The Median House Has Went From 2019 274 600 With Qualifying Income Of 50 592

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Coach Introduces Integration With Loansense To Help Federal Student Loan Holders Become Homeowners And Increase Purchase Power Send2press Newswire

A Picture More Misleading Than A Thousand Words John Burns Real Estate Consulting

11 Things You Must Know Before Buying A House Hubpages

The Difference In Retirement Savings If You Start At 25 Vs 35

One In Three Canadians Considering Workarounds To Buy A Home Amidst Rising Prices Supply Shortages

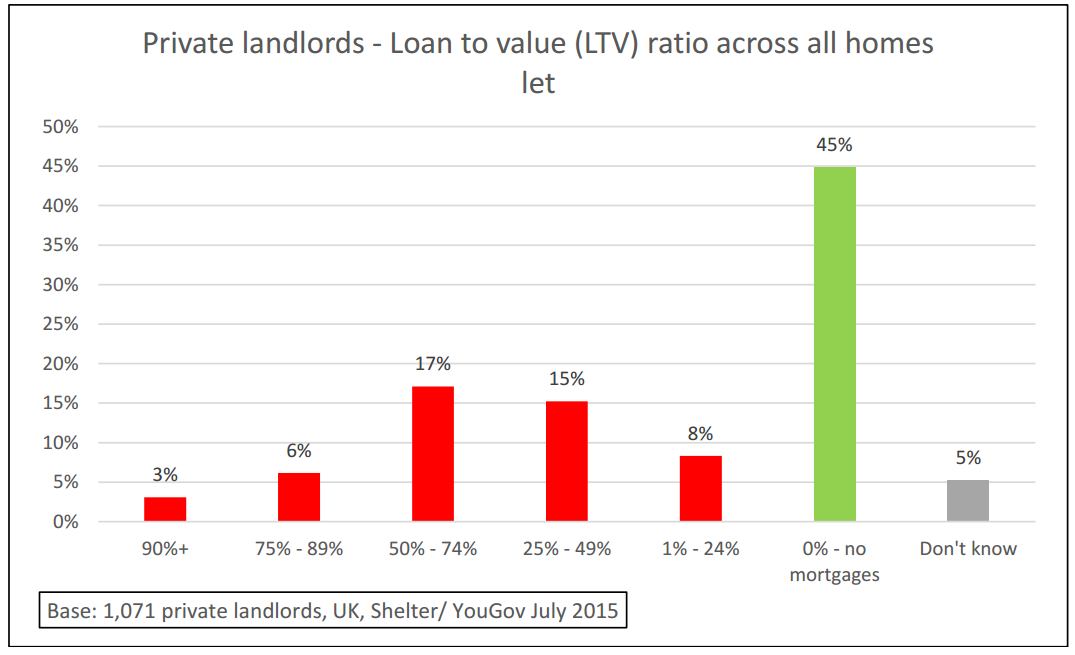

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

Formfree Expands Its Verification Of Income And Employment Network Through Partnership With Truv Send2press Newswire

Bac3312018ex991

How To Visit The Us For Over 35 Days And Still Exclude Foreign Income Money Matters For Globetrotters

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Percentage Of Income For Mortgage Payments Quicken Loans

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram